Financial Overview

Engineered for Profitability and Low Lender Risk

Clear projections, disciplined use of funds, and conservative assumptions.

Year 1 Income Statement (Summary)

Projections are built from fully costed menu items, realistic volume assumptions, and a conservative operating schedule. The focus is on maintaining strong cash flow, healthy margins, and ample coverage for debt service.

| Item | Amount (Year 1) | Notes |

|---|---|---|

| Total Revenue | $68,040 | Approx. 30 customers/day, 4–7 operating days/week over the year |

| Cost of Goods Sold | $21,774 | Food, beverages, and disposables (~32% of revenue, below industry norms) |

| Gross Profit | $46,266 | Gross margin of ~68% |

| Operating Expenses | $11,070 | Insurance, permits, fuel/propane, utilities, marketing, etc. |

| Debt Service (Loan Payments) | $4,872 | $20,000 @ 8% APR over 5 years (~$406/month) |

| Owner Draw (Planned & Flexible) | Up to $9,000 | Actual draws in early months expected to be lower to protect reserves |

| Projected Net Profit | $21,324 | ~31% net margin after all expenses, debt service, and planned draws |

In practice, the owners intend to delay or reduce draws during the first three months until the truck demonstrates stable cash flow. This provides additional protection for working capital and loan repayment.

$20,000 Capital Allocation

The $20,000 loan is the minimum viable capital required to purchase and convert the vehicle, outfit the kitchen, secure permits and insurance, and provide a buffer for loan payments and contingencies.

| Category | Amount | Description |

|---|---|---|

| Vehicle & Build-Out | $6,170 | Ambulance purchase, tax, registration, and basic construction/teardown materials |

| Kitchen Equipment | $7,014.50 | Refrigeration, prep table, panini presses, sinks, generator, water system, safety equipment |

| Permits, Licenses & Insurance | $1,500 | Municipal permits, health department permits, ServSafe certification, and initial insurance |

| Loan Payment Buffer (6 months) | $2,460 | Reserves to cover loan payments during build-out and early launch |

| Smallwares & Initial Inventory | $1,000 | Utensils, pans, containers, and first weeks of food and disposables |

| Contingency Reserve | $1,855.50 | Vehicle repairs, overruns, or unexpected build and opening costs |

| Total | $20,000 |

Budget & Layout Visualization

This budget is not just a spreadsheet; it is tied to two fully-costed, health-code-compliant physical layouts. This proves the project is viable whether we secure our ideal large-box truck or a more common small-box unit.

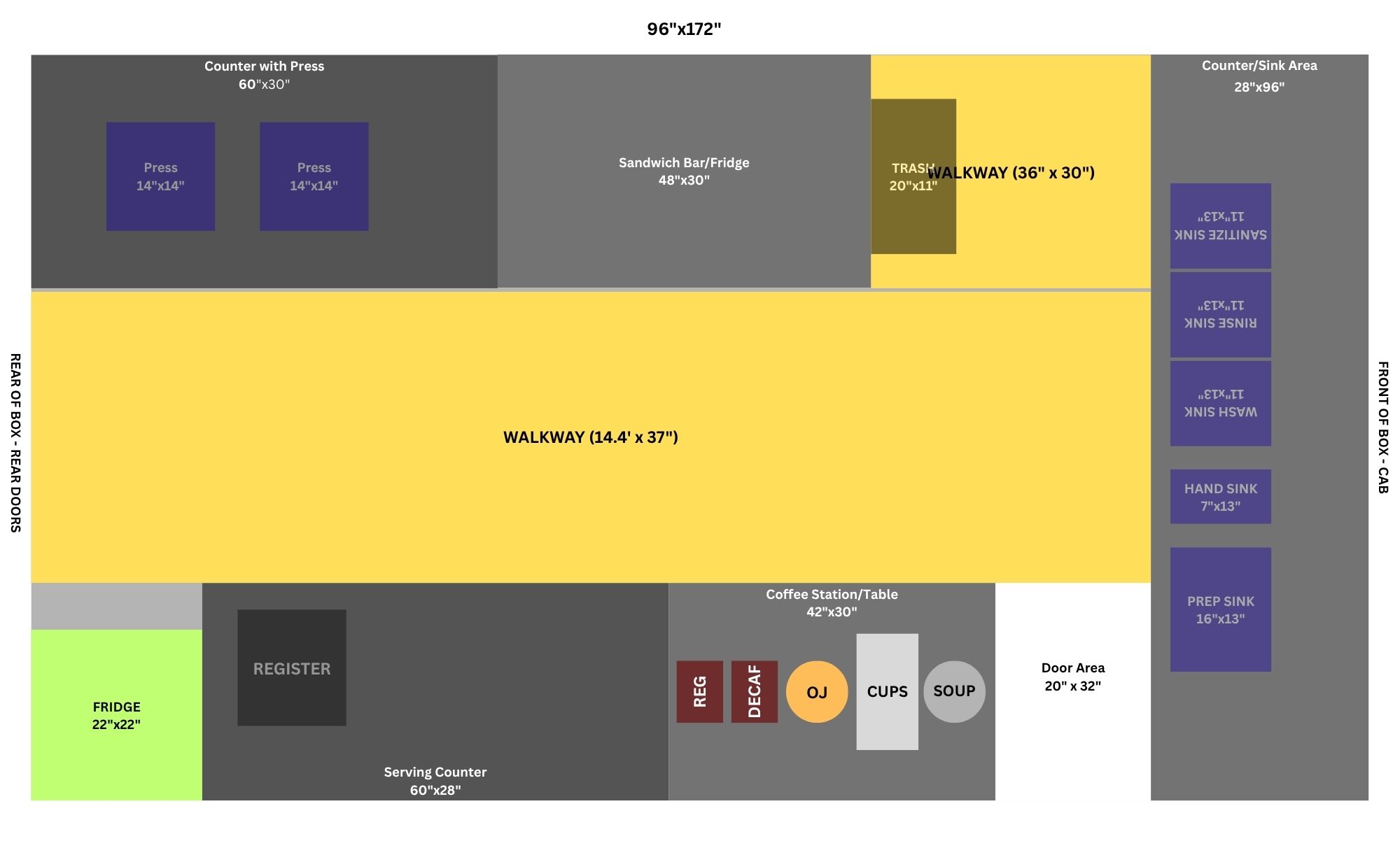

Ideal Layout (96"x172" Box)

This is our primary plan, built for the 48" NAFCOOL prep table listed in the budget. It offers a more spacious 14.4" walkway, optimizing workflow.

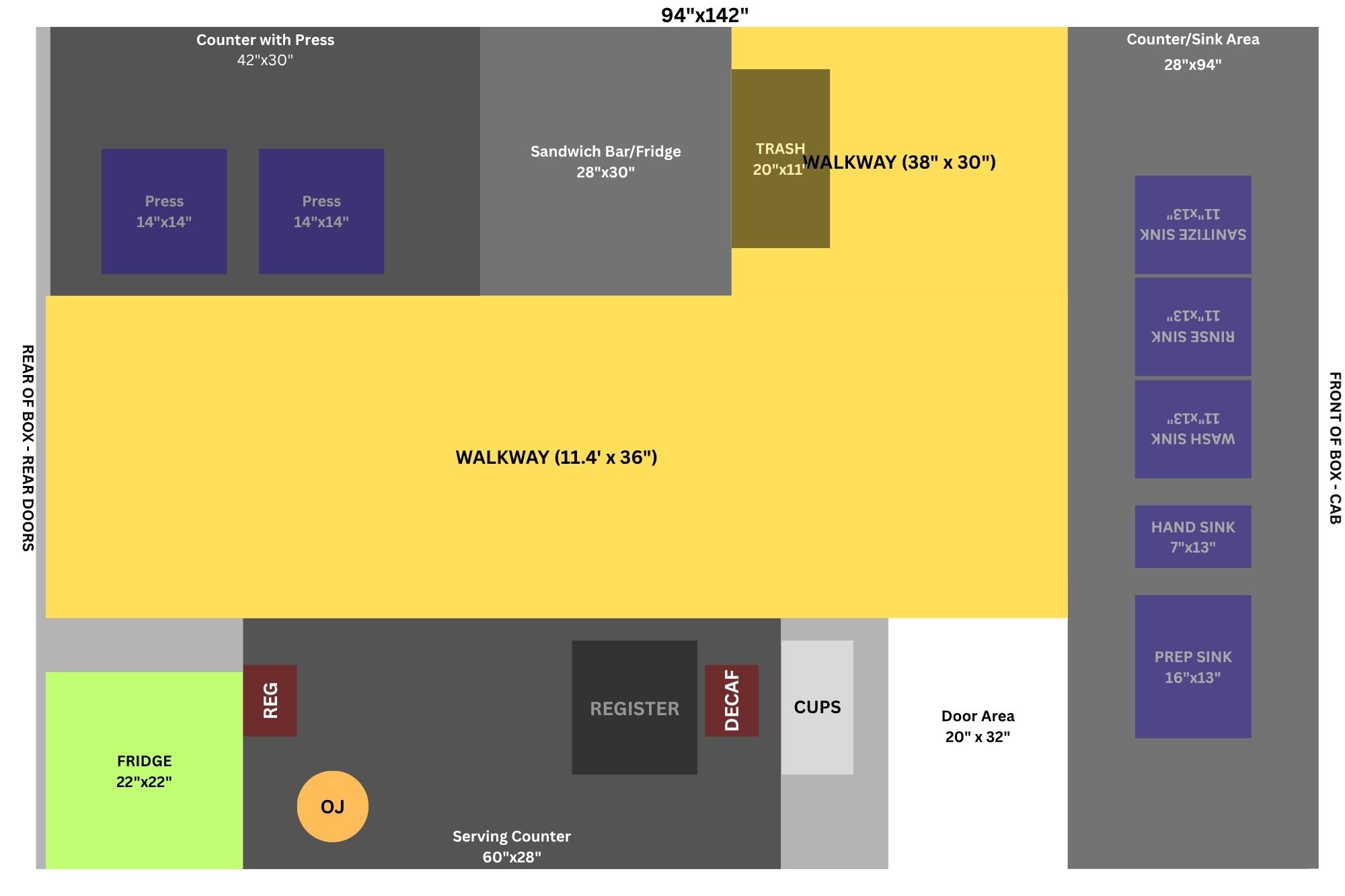

Contingency Layout (94"x142" Box)

This is our "worst-case-scenario" plan, proving we can launch in a smaller, more common ambulance. This layout swaps for a 28" prep table and is fully viable.

COGS & Menu-Level Economics

Each menu item has been costed line-by-line for ingredients, packaging, and beverages. The goal is maintaining COGS below typical industry ranges (35–40%) while keeping pricing fair for our market.

Breakfast bagel meals and core melts typically fall in the 21–32% COGS range (including chips and water), with an average around ~29% for meals. This provides a built-in buffer above our base food-cost target and helps protect margins if ingredient prices increase.